Working for yourself has its perks. In theory there’s more autonomy when you’re calling the shots. But that autonomy often comes at a cost. Taxes can be particularly burdensome on the self-employed. And the recent Tax Cut and Jobs Act of 2017 (TCJA) re-shuffles the deck on many age-old tax strategies. Navigating the effects of the TCJA is something everyone will need to do. But for self-employed professionals, TCJA offers both threat and opportunity.

The TCJA created a new species of taxpaying entity known as a Specific Service Trade or Business (SSTB). Along with a new category of income called Qualified Business Income (QBI), and corresponding QBI deduction.

Unfortunately for most SSTBs, this new QBI deduction begins to be phased-out for married filers at 2018 taxable incomes of $315,000 ($157,500 for single filers). For 2019, these phase-outs start at $321,400 and $160,700, respectively.

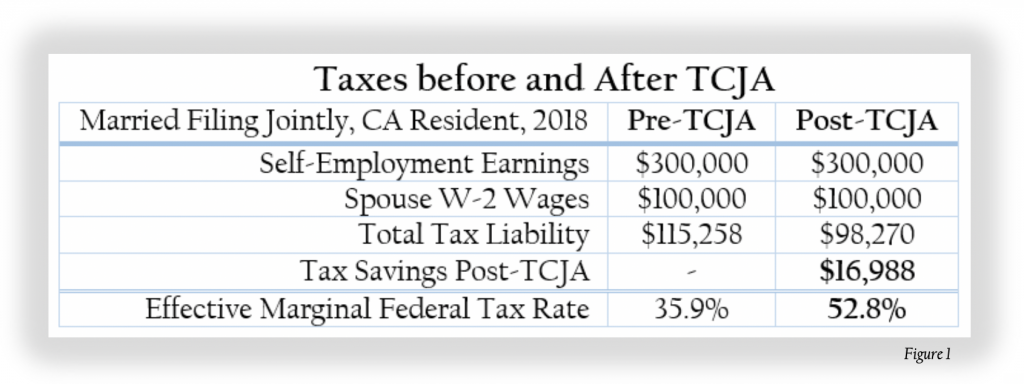

Deduction phase-outs can produce unanticipated, and sometimes nasty tax effects. For example, consider a California couple earning a $400,000 a year, with $300,000 of that coming from self-employment. While the TCJA reduced their overall tax liability by almost $17,000, the QBI phase-out creates an effective federal marginal tax rate of 52.8%. Add in California’s 10.5% effective rate, and this couple faces a combined 63.3% effective marginal tax rate![i]

So while the TCJA reduced this couple’s 2018 tax liability by $16,988, the QBI deduction phase-out, along with California taxes, conspire to create an effective marginal tax rate almost twice the 32% federal bracket they would otherwise find themselves in!

Nevertheless, there’s great possibility for those who know where to look – as the new QBI deduction phase-out itself can offer some self-employed professionals[ii] the opportunity to turn their taxes into savings and investment.

For example, our couple could use their post-TCJA tax refund to make a pre-tax retirement plan contribution. Self-employed professionals have access to an array of different pre-tax retirement plan options, including SIMPLE, Sep-IRA, Individual 401(k), Profit Sharing and even cash balance Defined Benefit plans. There’s no shortage of plans available for the self-employed.

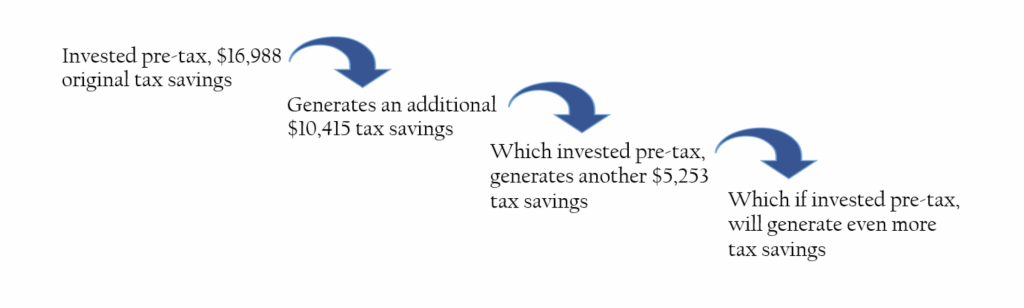

Invested pre-tax, a $16,988 refund would generate another $10,415 in 2018 tax savings! That’s right. While 40, 50 and even 60-plus-percent effective tax rates can be a consequence the new QBI deduction phase-out, those same tax rates reward quite handsomely self-employed professionals able to take advantage of pre-tax retirement savings.

But why stop there? Why stop at generating an additional $10,415 when re-investing that additional tax savings would yield another $5,253 tax break. In other words, by investing the original $16,988 pre-tax, we’re able to generate additional tax savings. And by reinvesting the additional tax savings, we can create even more tax savings – which if reinvested, in turn can create even more additional tax savings.

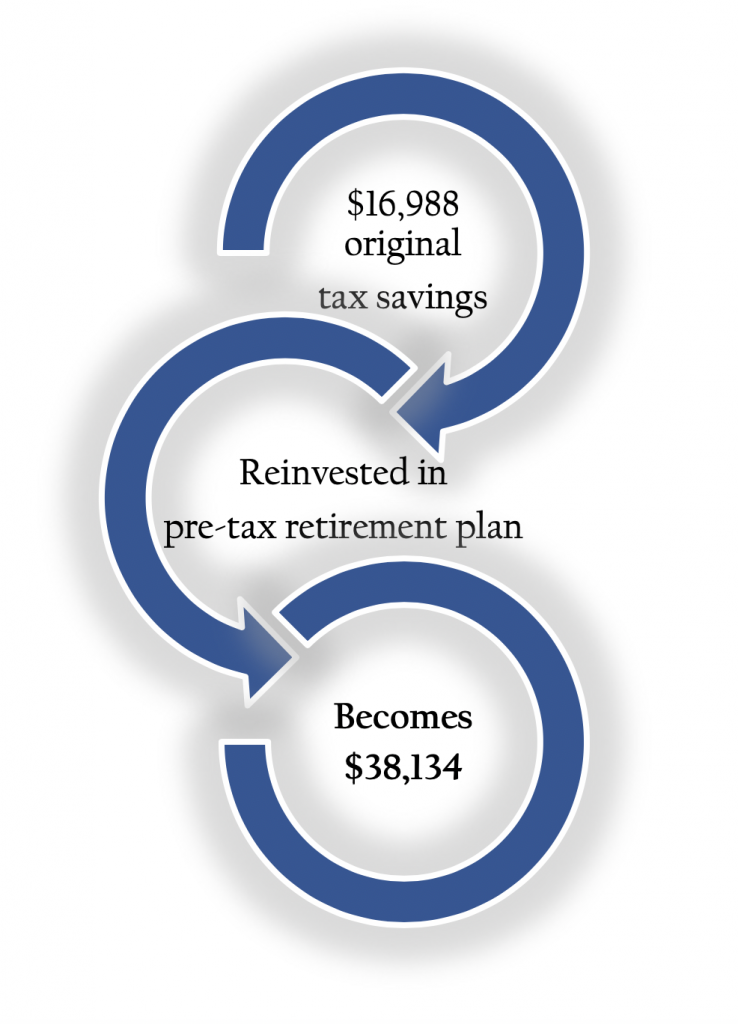

So far, we’ve taken an original tax refund of $16,988 and turned it into a retirement plan contribution of $32,656. But in this example you can, and probably should, rinse and repeat this reinvest-the-tax-savings–in-order-to-generate- more-tax-savings-to-reinvest strategy all the way up to $38,134 before you run out of incrementally generated tax savings to reinvest.

“Most financial planners create financial plans. We create financial possibility.”

Turning $16,988 of TCJA tax savings into $38,134 of retirement plan contributions might feel like creating money to fund retirement out of thin air. That’s because in a way, it is!

Most financial planners create financial plans. We create financial possibility. Debt and taxes tend to make up a disproportionate amount of household expense. But the new Tax Cut and Jobs Act is helping us turn even more Debt & Taxes into Savings & Investment™ for the self-employed.

Too often people fear that to achieve their financial goals they’ll be forced to tighten their belt, cut back on doing the things they love, or simply go without. Many hesitate to hire a financial planner because they don’t even know what’s possible. We’re here to change all that.

If you think our unique approach can help, please let us know. We’d be honored to serve you.

[i] Effective marginal tax rates refer to the tax rate paid on the next $1,000 of taxable income.

[ii] Taxpayers with only QBI income may find their taxable income limits their QBI deduction. The opportunity described above is therefore most applicable where W-2 wages are also present.